To qualify for the $100 statement credit, you must spend $1,000 in total Purchases using the Account within 90 days of the Account opening date. If you are approved for an Account in response to this specific offer, you are eligible to earn a One-Time Bonus Offer ("One Time Bonus Offer") of 10,000 Bonus Points, equal to $100 in the form of a statement credit. There is a balance transfer fee of $5 or 3% of each transfer, whichever is greater.ġEligible purchases do not include purchases of any cash equivalents, money orders, and/or gift cards or reloading of gift cards. After that, 19.99%, 24.99% or 29.99% variable APR based on your creditworthiness. * Read important terms and conditions for details about APRs, fees, eligible purchases, balance transfers and rewards program details. Balance transfer 0% introductory APR for first 15 billing cycles after account opening. Click the Cancel button to return to the previous page.View Credit Card Agreements for TD Bank Credit Cards. We are not responsible for another entity's use of your information.Ĭlick the OK button to leave Ion Bank's Internet site.

If you have any questions about another entity's use of your personal information, you should review that entity's privacy policies and/or ask that entity directly. Other website operators may collect information about you and use such information in accordance with their policies and procedures. The Bank makes no warranties as to the operation or usefulness of other websites. The Bank has no responsibility for products and services offered through another entity's website. The content, accuracy, and opinions expressed and other links provided by these resources are not investigated, verified, monitored or endorsed by the Bank. Your use of hyperlinks to the websites of others is at your own risk. When you use a hyperlink to visit the website of another person or entity, you leave the Bank's website. The links to third party websites are provided solely as a matter of convenience to the visitors of the Ion Bank ("Bank") website. To get started with Online Banking, enroll today!Īttention: You are leaving the Ion Bank website. Online Banking is a safe and convenient way to manage your finances, yet an Ion Bank team member is only a phone call away if you need further assistance. This convenient service is another way we can help protect you against identity theft. Ion Bank customers can see their eStatements when logged in to Online Banking. Receive your monthly statements and check images online with our convenient and environmentally friendly eStatements. Start managing your finances today!Ĭlick here for a video that gives an overview of how iMoney works. Once you register for iMoney in iBanking, your Ion Bank accounts will be imported automatically.

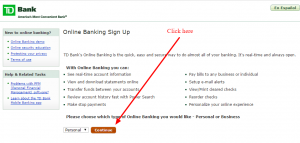

IMoney is designed to help you better understand and manage your finances, so you can spend less time worrying about money and more time enjoying the security and comfort it affords you. Budgeting, account aggregation, categorization and mobile access are just a few of the tools to guide you along your way. Integrated with our Online Banking, iMoney empowers you to take control of your finances and simplify your life. See all your financial transactions in one place – no need to sign into all your separate financial institution accounts and online payment portals! IMoney is a reliable, real-time financial aggregation tool that helps you control your money and be financially healthy. Bill Pay is a convenient way to make payments with scheduling options, the ability to transfer funds, set reminders, alerts and monitor fraud to help protect you from unauthorized payments. Receive and pay your bills electronically, eliminating the need to write and mail checks. Export your account history to Quicken® or QuickBooks®.See monthly statements and check images.Instantly deactivate and reactivate your Debit or ATM card.Send money directly to a bank account with Wire Transfer services.View your balance and transaction history.Securely sign into your account on your smartphone, tablet or computer and bank on your schedule.

Spend less time waiting in line and more time getting things done. Opening an account with Ion Bank allows you to stay connected to your money like never before! With 24/7 services including Online Banking, Mobile Banking and Bank-by-Phone, convenient account access is at your command. When you’re on the go, Ion Bank is right there with you.

0 kommentar(er)

0 kommentar(er)